A Gold IRA offers investors a unique way to diversify retirement portfolios with physical gold and silver, serving as an inflation hedge and global asset diversifier. When choosing gold IRA companies, prioritize security by selecting reputable, regulated firms offering high-security vaults and transparent pricing. Top providers ensure safe storage through advanced systems, 24/7 surveillance, climate control, armed guards, and strong access protocols. Evaluate storage fees, insurance coverage, and additional services to secure the best conditions for your gold IRA investment, safeguarding your retirement future during volatile economic times.

“Discovering the best gold IRA companies with superior storage options can be a game-changer for investors looking to diversify their portfolios. This comprehensive guide explores the benefits of Gold IRAs, from financial security to potential tax advantages. We’ll walk you through the critical factors to consider when choosing a provider, including trustworthiness and expertise. Then, we unveil top-rated gold IRA companies known for their secure storage solutions, helping you make an informed decision in the world of precious metal investments.”

- Understanding Gold IRAs and Their Benefits

- Key Factors to Consider When Choosing a Gold IRA Company

- Top Gold IRA Companies Offering Superior Storage Solutions

- Secure Storage Options: A Deep Dive into the Methods Used

- Compare Storage Fees and Services: Uncovering the Best Value

- Conclusion: Navigating the Best Gold IRA Companies for Optimal Storage

Understanding Gold IRAs and Their Benefits

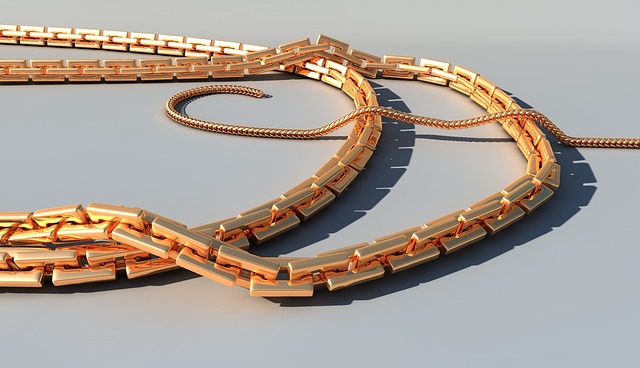

A Gold IRA, or Gold Individual Retirement Account, is a unique investment option that allows individuals to hold physical gold and silver as part of their retirement portfolio. Unlike traditional IRAs that primarily invest in stocks, bonds, or mutual funds, a Gold IRA offers a tangible asset with intrinsic value. This type of IRA provides several benefits. Firstly, it serves as an effective hedge against inflation since precious metals often retain their worth during economic uncertainties. Secondly, gold and silver are global assets, meaning they can provide diversification to your investment strategy, reducing overall risk. Furthermore, holding physical metals in a Gold IRA offers peace of mind, ensuring that you have control over your retirement funds and their underlying value.

When considering gold IRA companies, it’s crucial to explore options with secure storage facilities. Top-tier gold IRA providers offer robust safety measures, including vault storage, to protect your precious metals from theft or damage. These companies also facilitate the buying and selling of gold and silver, making it convenient for investors to manage their assets. In today’s market, where economic instability can lead to significant investment shifts, a Gold IRA provides a stable haven, allowing individuals to secure their retirement future with one of the oldest stores of value known to humanity.

Key Factors to Consider When Choosing a Gold IRA Company

When selecting a gold IRA company, several key factors come into play. Firstly, ensure the firm is reputable and regulated by relevant financial authorities to guarantee security for your investment. The storage options they provide are another critical aspect; look for companies that offer secure, insured storage facilities, preferably in high-security vaults, to safeguard your physical gold assets.

Consider the types of gold products allowed in your IRA, such as bullion, coins, or bars. Some companies might have specific preferences or restrictions. Additionally, evaluate their fees, including annual storage costs and potential investment charges, to ensure they align with your budget. Reputable gold IRA companies should offer transparent pricing and easy navigation through the investment process.

Top Gold IRA Companies Offering Superior Storage Solutions

When it comes to storing your precious metals, choosing a reliable and secure option is paramount. Top-tier Gold IRA companies understand this critical aspect and offer robust storage solutions to safeguard your investment. They utilize high-security facilities, often located off-site, ensuring your gold and silver bars, coins, or bullion are stored in a controlled environment, protected from theft, damage, or loss.

These companies invest in state-of-the-art vault systems, employing advanced security measures like 24/7 surveillance, temperature-controlled rooms, and high-tech locking mechanisms. Some even offer additional benefits like insurance coverage for peace of mind. By partnering with these reputable gold IRA companies, investors can rest assured that their assets are in good hands, allowing them to focus on the potential growth of their retirement portfolio.

Secure Storage Options: A Deep Dive into the Methods Used

When it comes to secure storage options for your gold IRA, top-tier companies employ several advanced methods to safeguard your precious metals. One of the primary safeguards is the use of highly secured facilities located in diverse geographical locations. These facilities are designed with state-of-the-art security systems, including 24/7 surveillance, armed personnel, and advanced alarm systems. Additionally, gold IRA companies often utilize high-tech storage containers that are made from robust materials, offering maximum protection against theft or damage.

Another crucial aspect is the implementation of strict access protocols. Only authorized personnel with specific security clearances can access the storage areas, ensuring a high level of discretion and safety for your assets. Moreover, many reputable gold IRA companies partner with secure vault providers, renowned for their robust infrastructure and stringent security measures. This multifaceted approach guarantees that your gold investments remain secure throughout their storage journey.

Compare Storage Fees and Services: Uncovering the Best Value

When shopping around for a gold IRA company, one of the most crucial factors to consider is their storage options and associated fees. Every firm will have different arrangements in place for safeguarding your precious metals, so it’s essential to compare what they offer. Some companies may store your gold at an independent depository while others might keep it in a secure vault within their facility. Look into the security measures in place, insurance coverage, and any additional services that come with the storage package.

In terms of value, you should examine the storage fees charged by each gold IRA company. These costs can vary significantly, so it’s beneficial to get quotes from multiple providers. Some companies might offer flat rates while others could charge based on the amount of precious metals stored. Additionally, explore whether there are any hidden fees or annual maintenance charges that could impact your overall investment. By meticulously comparing storage options and fees, you’ll be able to make an informed decision and secure the best value for your gold IRA.

Conclusion: Navigating the Best Gold IRA Companies for Optimal Storage

When selecting a gold IRA company, choosing one that offers robust and secure storage options is paramount for ensuring your precious metals are safeguarded. The best storage facilities provide advanced security measures such as high-security vaults, 24/7 surveillance, and climate control to protect against theft, damage, or loss. Additionally, reputable gold IRA companies often partner with well-established, insured custodians who adhere to stringent industry standards, further mitigating risks associated with storing physical gold and silver assets.

Navigating the landscape of gold IRA companies requires diligence, but by focusing on those that prioritize top-tier storage solutions, investors can have peace of mind knowing their valuable collections are in capable hands. This strategic approach not only safeguards investments but also paves the way for long-term financial security and wealth preservation.

When selecting a gold IRA company, prioritizing secure and reliable storage options is paramount. Our comprehensive guide has illuminated the top providers offering superior storage solutions, ensuring your precious metals are safeguarded. By carefully considering factors like security measures, insurance, and fee structures, you can make an informed decision to maximize the benefits of your gold IRA investment. Remember, choosing the right company with robust storage options paves the way for a secure and prosperous financial future.